New Virginia Law Could Spark Drastic Change to the National NIL Landscape

On Thursday April 18, Governor Youngkin of Virginia signed into law a bill which will allow colleges and universities in Virginia to directly compensate their

On Thursday April 18, Governor Youngkin of Virginia signed into law a bill which will allow colleges and universities in Virginia to directly compensate their

In December 2023, members of the Oregon female beach volleyball and rowing teams filed a lawsuit under Title IX of the Educational Amendments. The women

Religious property disputes can be some of the most emotionally charged legal battles. They often involve deeply held beliefs and the legacy of a community. If you find yourself embroiled in such a dispute, it’s easy to feel overwhelmed and discouraged. But here’s the good news: with perseverance and a strategic approach, you can prevail. The Young-Nak church experience demonstrates the importance of perseverance in these cases and offer practical guidance to help you navigate the legal process.

Federal appellate courts, like the Circuit Courts of Appeals, typically operate with panels of three judges who hear arguments and issue decisions. However, there’s a provision that allows the entire court, all the judges on the bench, to rehear a case. This is called an en banc hearing

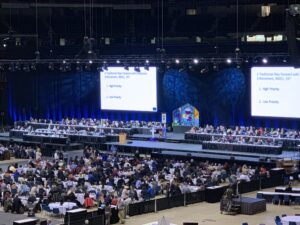

There are two main issues to be decided in the 2024 General Conference of the United Methodist Church. The answer to both issues will have a significant impact on the future of the denomination and will require local congregations’ thoughtful consideration regarding their own affiliation with the denomination.

In the past six months, the most frequently asked question that I have received involves senior pastor transitions. While we do not recruit pastors, we

This is the story of Chilmark Community Church located on Martha’s Vineyard, Massachusetts, and its exit from the New England Annual Conference of the United Methodist Church.

A governmental entity has a very limited role when it comes to determining if a plaintiff is “religious enough,” or engaged in “religious activity,” for purposes of RLUIPA

Church mergers, often driven by pastoral transitions, are becoming increasingly common. And while the reasons are complex and varied, one unexpected trigger is emerging – senior pastor transitions.

Change is inevitable, even for our beloved faith communities. And one of the most significant transitions a church can experience is the departure of its senior pastor. It’s a time of mixed emotions – gratitude for the outgoing pastor’s contributions, sadness at their leaving, and uncertainty about the future. But with careful planning and open communication, a senior pastor transition can be an opportunity for growth and renewal.

Problem Solvers for Religious and Nonprofit Organizations, Property Owners, and Businesses.

Do you have a question? We would love to hear from you. Click the button below and we’ll get in touch with you shortly.

Please note that this website may be considered attorney advertising in some states. Prior results described on this site do not guarantee similar outcomes in future cases or transactions.